Your billing department is doing its job. Claims go out. Payments come in. The numbers look reasonable.

So why does profitability keep slipping?

Here's the uncomfortable truth most practice owners eventually discover: billing isn't the problem. The real issue is the leaky bucket your revenue lands in.

If you run a healthcare practice generating $500K to $4M in revenue with five or more employees, you've likely felt this disconnect. Revenue appears stable: maybe even growing: but profit margins compress year after year. Cash feels tighter. Reinvestment becomes harder.

Traditional healthcare revenue cycle management focuses heavily on claims submission, denial management, and collections. These matter. But they only address one side of the equation.

The other side? That's where profit actually disappears.

The Leaky Bucket Problem

Picture your practice's revenue as water flowing into a bucket. Billing determines how much water enters. But if that bucket has holes: operational inefficiencies, bloated overhead, cash flow dysfunction: it doesn't matter how fast you fill it.

You'll never get ahead.

Most practices losing profit aren't failing at billing. They're failing at containment.

Common leaks include:

-

Staffing costs that outpace revenue growth. Salaries, benefits, and competitive pay pressures represent the single largest expense driver for practices in 2025. These costs climb regardless of billing performance.

-

Operational inefficiency baked into daily workflows. High staffing ratios, outdated systems, and disorganized processes generate weaker cash flow even when revenue looks healthy.

-

Cash flow dysfunction. Aging accounts receivable, claims unpaid beyond 90 days, and insufficient cash reserves create profitability pressure: even when collections appear strong.

-

Payer concentration risk. Heavy reliance on a single payer (especially Medicare) creates structural vulnerability. One reimbursement cut can compress margins overnight.

-

Rising administrative burden. Compliance requirements, reporting obligations, and drug costs continue climbing annually. These fixed costs squeeze margins from every direction.

The pattern is consistent: practices can show strong collections while simultaneously struggling financially. Revenue and profit are not the same thing.

Why Traditional Billing Fixes Miss the Mark

When profit shrinks, the instinct is to focus harder on billing. Hire a better billing company. Renegotiate payer contracts. Chase denials more aggressively.

These aren't bad moves. But they're incomplete.

Business coaching for healthcare practices often reveals a pattern: owners invest heavily in revenue cycle improvements while ignoring the operational dysfunction eating their margins.

Consider this scenario:

A practice collects $1.2M annually with a 95% clean claims rate. By billing metrics, they're succeeding. But staffing costs consume 55% of revenue (industry benchmark: 45–50%). Administrative overhead runs 8% higher than comparable practices. Cash reserves cover less than 30 days of operating expenses.

On paper, the practice is profitable. In reality, it's one slow month away from borrowing against a line of credit.

This is the profitability paradox. The numbers look fine until they don't.

The Structural Vulnerabilities You're Probably Ignoring

Operational efficiency in healthcare isn't glamorous. It doesn't make for exciting conference topics. But it's where sustainable profit lives.

Here's what structural vulnerability actually looks like:

Staffing Ratios That Don't Scale

Every hire increases overhead. But not every hire increases capacity proportionally. Practices with undefined roles, unclear accountability, and no productivity benchmarks end up overstaffed relative to output.

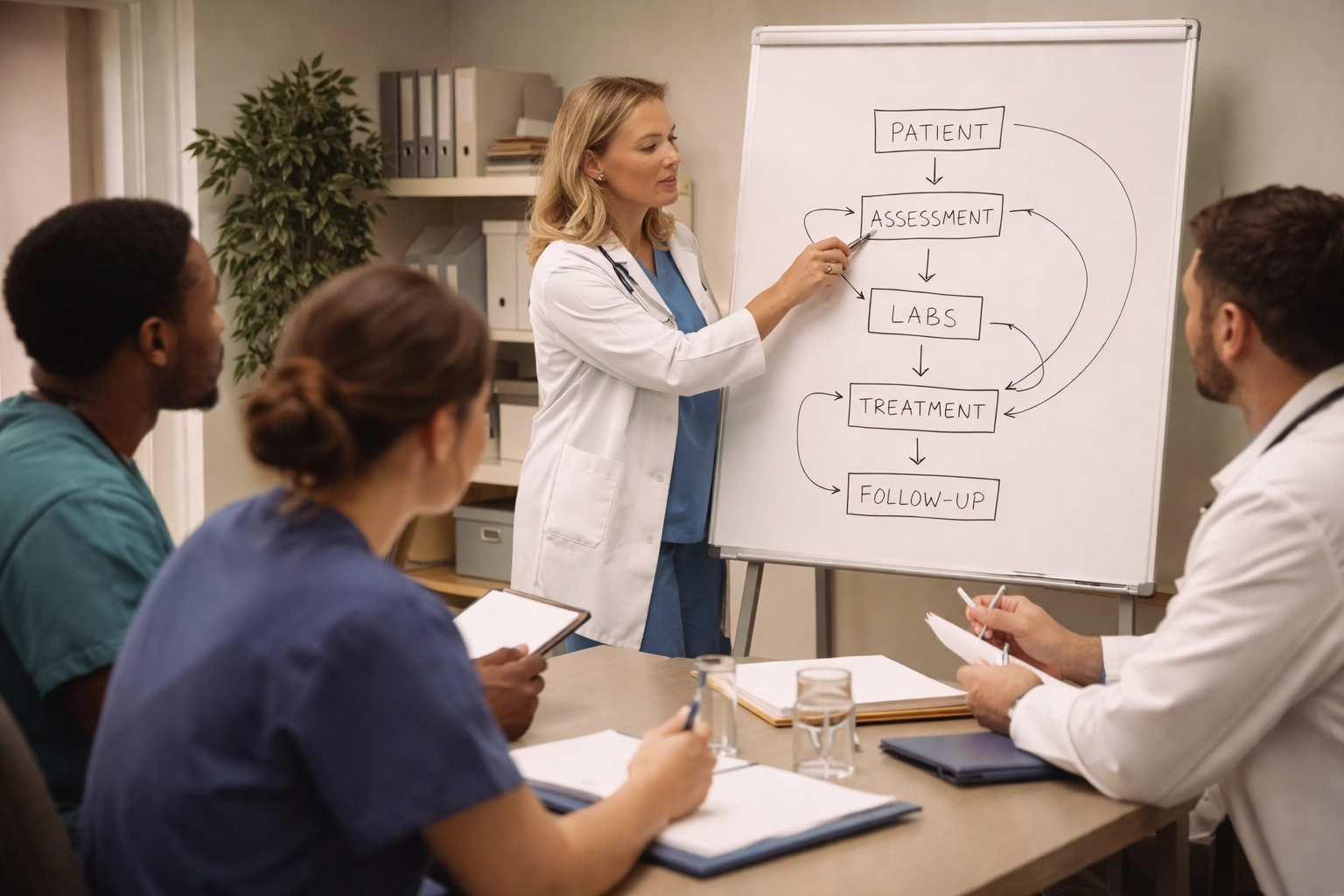

Workflow Leakage

How many touches does a patient encounter require from scheduling to payment posting? Every unnecessary step costs time, labor, and money. Most practices have never mapped this.

Cash Flow Blindness

Many owners track revenue monthly but don't forecast cash weekly. They know what came in last quarter. They don't know if they can make payroll three weeks from now without sweating.

Technology Debt

Outdated systems require workarounds. Workarounds require staff time. Staff time costs money. The practice pays twice: once for the legacy system, again for the inefficiency it creates.

What Actually Fixes the Leaky Bucket

Addressing profit erosion requires looking beyond billing metrics. It demands an honest operational assessment.

Start here:

-

Benchmark your staffing costs. Calculate total staffing expense (salaries, benefits, taxes, contractors) as a percentage of revenue. Compare to industry benchmarks. If you're above 50%, there's margin to recover.

-

Map your patient encounter workflow. Document every step from first contact to final payment. Identify redundancies, handoff failures, and bottlenecks. This is where hidden labor costs live.

-

Build a 13-week cash flow forecast. Stop managing by bank balance. A rolling forecast reveals cash crunches weeks before they hit: giving you time to respond strategically instead of reactively.

-

Audit your payer mix. Calculate what percentage of revenue comes from your top three payers. If one payer represents more than 40%, you're exposed. Diversification protects margin.

-

Quantify administrative burden. Track how many hours per week your clinical staff spends on non-clinical tasks. Multiply by their hourly rate. That number is your administrative leak.

These aren't billing fixes. They're operational fixes. And they're where sustainable profitability actually lives.

The Bottom Line

Your billing process might be working exactly as designed. Claims go out, payments come in, denials get worked.

But if your practice is still losing profit, billing isn't the problem.

The problem is everything that happens after the money arrives.

Staffing costs that climb faster than revenue. Workflows that waste labor. Cash flow you can't see coming. Payer concentration that creates fragility. Administrative burden that compounds annually.

These are structural issues. They require structural solutions.

Healthcare revenue cycle management gets you paid. Operational efficiency in healthcare determines whether you keep it.

Get Clarity on Your Practice's Real Profit Leaks

If your revenue looks healthy but profit keeps shrinking, there's a structural issue worth finding.

At TLN Consulting Group, we help healthcare practice owners identify the operational leaks that billing alone can't fix: and build systems that protect margin long-term.

Book a 15-Min Session to pinpoint where your profit is actually going and what to do about it.