If 2025 felt like you were running uphill with a backpack full of rocks, you're not alone. Between inflation hovering around 3%, hiring nightmares, and economic uncertainty, many business owners watched their growth plans get stuck in neutral.

But here's the thing: 2026 doesn't have to be a repeat performance. With just two weeks left in 2025, now's the perfect time to pivot from survival mode to strategic growth mode. Let's dive into 10 proven strategies that'll help you beat both inflation and hiring challenges in the year ahead.

1. Stop Apologizing for Price Increases

Your pricing strategy needs a reality check. If you haven't reviewed your prices in the last 18 months, you're essentially paying customers to work with you.

Reframe price increases as value alignment, not apologies. Present them as investments in cutting-edge technology, better processes, and superior service delivery. Customers expect price adjustments now: use that acceptance window to implement overdue corrections.

While in many cases, increasing prices are directly correlated to increased cost, you do not have to increase the price on everything. Selective increases are often smarter—blanket adjustments across all products or services can cause consumers to lose trust in your brand. Be mindful of customer perceptions and use transparency to maintain credibility.

Action step: Complete a pricing audit by January 15th. Compare your current rates to market standards and factor in your actual cost increases since your last adjustment.

2. Conduct a No-BS Margin Audit

Before you finalize 2026 budgets, get brutal about which products or services actually make money under current operational costs.

Identify which offerings generate losses and which clients consistently receive more value than they pay for. Replace assumptions with hard financial data. You might discover you're subsidizing unprofitable relationships while your best clients aren't paying enough.

Action step: Analyze profitability by client and service line. Cut or reprice anything with margins below 20%.

3. Build Three-Scenario Forecasts

Ditch single-point forecasts: they're about as useful as a weather app that only shows sunny skies.

Model three scenarios for 2026:

- Best Case: Lower inflation with increased demand

- Base Case: Steady 3% inflation with moderate growth

- Challenge Case: Higher costs from tariffs with tighter cash flow

This approach prepares your business for multiple outcomes instead of creating anxiety around predicting one perfect scenario.

4. Lock in Supplier Rates Now

Before potential tariff changes hit in 2026, negotiate fixed rates with your key suppliers. Use current economic conditions as leverage for better terms.

Review every vendor agreement and push for multi-year contracts with locked pricing. Your future self will thank you when competitors are scrambling with increased costs.

Action step: Prioritize your top 5 suppliers and initiate contract renegotiations before year-end.

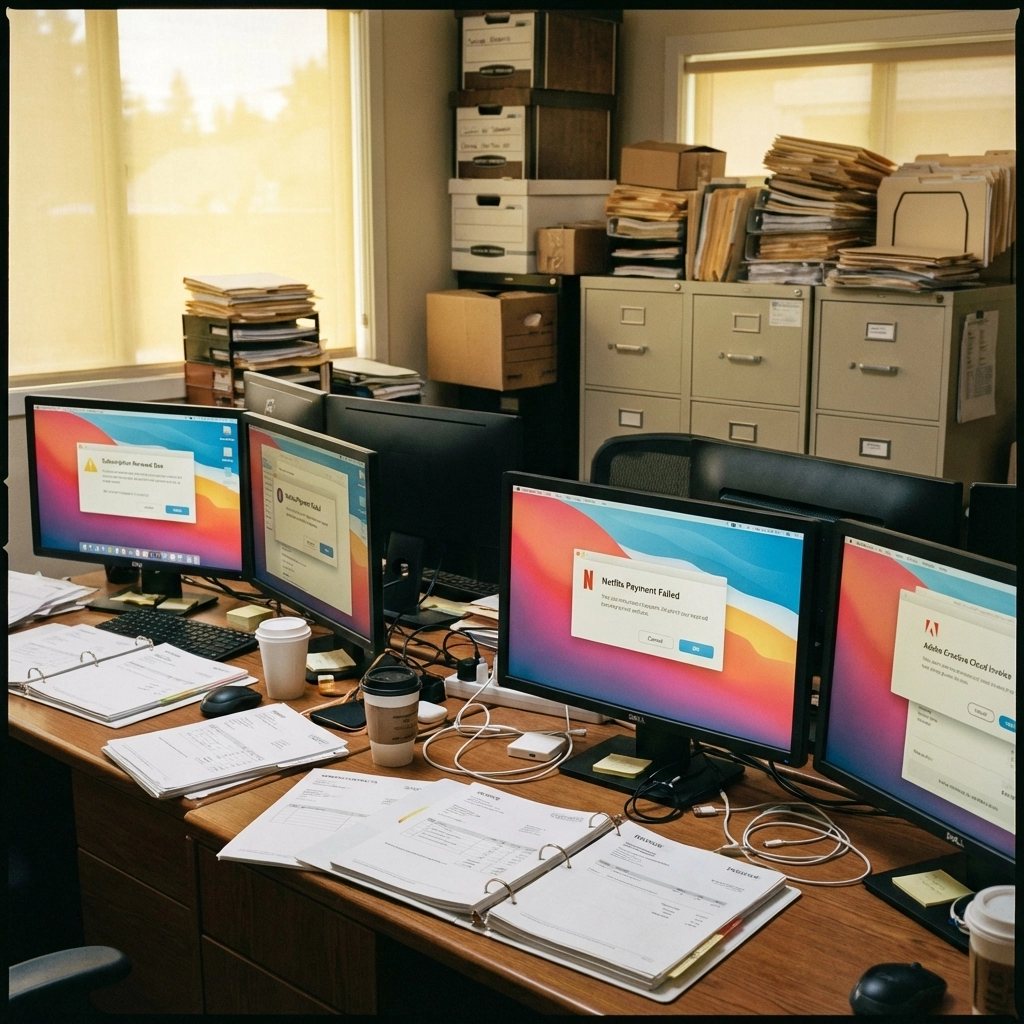

5. Eliminate the Hidden Cost Creeps

At 3% inflation, you can't blame macro conditions for profit erosion anymore. The culprit is likely internal inefficiencies that have been slowly bleeding your margins.

Address subscription service bloat, vendor price creeps, and underpriced legacy clients. Trim operational inefficiencies and redirect those savings toward strategic investments.

Action step: Audit all recurring expenses and cancel anything that doesn't directly contribute to revenue or customer satisfaction.

6. Invest in Game-Changing Technology

Use efficiency gains to fund investments in automation, AI, and better business systems. These aren't nice-to-haves: they're survival tools for 2026.

Technology improves profitability and operational capacity while positioning your business for sustainable growth. Companies leading in technology investments are averaging $187,000 in planned capital expenditures for 2026.

Consider our business bottleneck quiz to identify where technology can have the biggest impact on your operations.

7. Solve Hiring Challenges with Creative Compensation

Traditional hiring approaches aren't working. Instead of competing on base salary alone, design compensation packages that align employee success with business performance.

Implement profit-sharing schemes and offer high-value, lower-cost benefits like flexible work arrangements, professional development stipends, and wellness programs. Transparent communication about financial goals builds team engagement and reduces turnover.

Action step: Survey your team about their preferred benefits and restructure compensation packages to include performance-based incentives.

8. Tap Into the Remote Talent Pool

Geography shouldn't limit your talent options. Embrace remote and hybrid work models to access skilled professionals regardless of location.

This approach solves two problems: you get better talent at competitive rates, and employees get the flexibility they increasingly demand. Win-win.

Set clear performance metrics and communication protocols. Focus on outcomes, not hours logged.

9. Turn Customers Into Recruiters

Your best employees often come from referrals, but most businesses handle employee referral programs poorly.

Create structured referral incentives that reward employees for successful hires who stay longer than 90 days. Make the process simple and the rewards meaningful: think cash bonuses, extra PTO, or professional development opportunities.

Action step: Launch a formal employee referral program with clear guidelines and attractive incentives.

10. Build Financial Resilience

Use this period of "quiet inflation" to strengthen your balance sheet. Recover margins through the strategies above and intentionally rebuild reserves.

Strong cash flow provides flexibility for unexpected challenges and opportunities. Connect your margin analysis directly to cash flow forecasts for robust financial planning.

Action step: Establish a goal to build 3-6 months of operating expenses in reserves by mid-2026.

Your Strategic Advantage for 2026

The fundamental shift required for 2026 is moving from defense to offense. Instead of hunkering down to weather challenges, use inflation as permission to reset pricing, refine operations, and redefine value propositions.

Proactive businesses treat economic headwinds as catalysts for recalibration. By addressing pricing, partnerships, and profitability strategically, you position your business to shift from margin compression to margin expansion.

The next two weeks are your runway to 2026 success. Pick three strategies from this list and implement them before January 1st. Your future self: and your bottom line: will thank you.

Need help prioritizing these strategies for your specific situation? Our team at TLN Consulting Group specializes in helping businesses navigate growth challenges and build sustainable systems. Contact us to discuss how we can accelerate your 2026 growth plans.